Subsidy Benefit Timeline

A step-by-step timeline for students showing key deadlines.

Subsidy Benefit FAQs

Provides helpful information and answers frequently asked questions.

Questions?

For more information about the subsidy benefit, please email us at Gs-subsidy@fsu.edu.

Health Insurance Subsidy Benefit for Graduate Assistants |

||||||||

|

At Florida State University, we believe that access to quality, affordable insurance is essential for the health of our students. To meet this objective, the university and the Graduate School established a subsidy benefit to help eligible graduate students (those students with a graduate assistant appointment meeting certain criteria) pay for health insurance. Subsidy benefits include:

|

|

|||||||

Health Insurance RequirementEvery full-time FSU student must show proof of comparable health insurance prior to registration. As a requirement for the Health Insurance Subsidy, insurance must be purchased through University Health Services. Note: If you already have state health insurance through a previous employer, please contact your department's HR representative to determine which insurance option is best for you. Policy Purchasing and Contact InformationThe way health insurance is managed, is changing for Fall 2024. For specific policy information on cost, coverage, how, enrollment works for the university-sponsored health insurance, visit the FSU Student Health Insurance website operated by University Health Services or call 850-644-6230. The plan offers optional health insurance coverage for dependents of FSU students.

|

|||||||||||||||||||||

Subsidy Benefit Process & Timeline

Once a university-sponsored plan has been purchased, policy documents are sent to students, and the charge for coverage appears in their Student Business Services account. Do not pay for the policy at this time.

The sign-up process for the subsidy benefit begins during the first week of classes each semester. Eligible students will receive an email from the Graduate School at their FSU student email address with instructions for requesting the benefit. Students must elect to opt-in for the benefit. Participation is not automatic.

Once students have elected to receive the benefit, the charge for coverage will be removed from their Student Business Services account within a week. The subsidy benefit will then be distributed during the semester over five paychecks.

Review this timeline for specific Fall 2025 dates.

Review this timeline for specific Spring 2026 dates.

Subsidy Benefit Amounts |

|||||||||||||

|

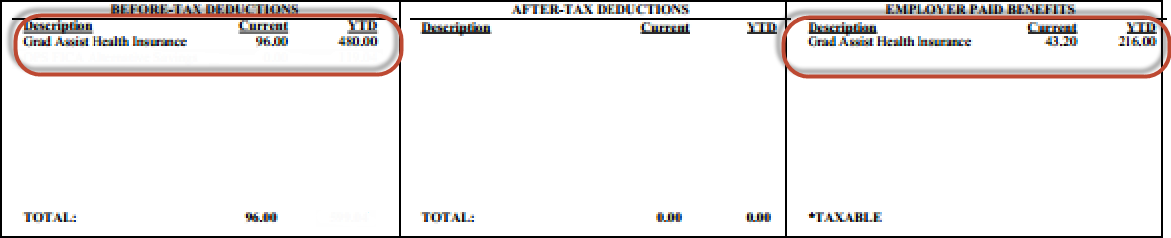

Eligible students will receive a subsidy benefit amount dictated by their FTE. This amount is the "Employer Portion" and will be applied to the total amount owed for the policy. The remaining amount, the "Employee Portion," will be automatically deducted from the employee's paycheck. Both the "Employer Portion" and "Employee Portion" must be contributed/deducted from the same five paychecks in order to qualify as a pre-tax benefit. |

|

||||||||||||

Special Cases

- For refund or general student account information, please contact Student Business Services at 850-644-9452.

- Students on the following fellowships/assistantships will receive the higher subsidy benefit amount (equivalent to .5 FTE status): FAMU Feeder Fellowship, Gubernatorial Fellowship, McKnight Fellowship, and Wilson-Auzenne Assistantship.

- Students with non-duty fellowships will receive the subsidy benefit by way of salary supplements rather than payroll deductions.

- Department Note: Graduate Assistants appointed to E&G funding will have the employer portion absorbed by the Graduate School. Graduate Assistants appointed to C&G, Local, and Auxiliary projects will have the employer portion charged to the project.

FAQs

Purchasing Health Insurance

Where do I purchase health insurance?

Visit the FSU Student Health Insurance website. Click on the "Purchase Now" button and login using your FSUID and password. Note: There are links and information on the page to assist with activating your FSUID if you haven't already done so. Follow the prompts. The charges will be posted to your account at Student Business Services, and you will be cleared to register.

*If it is for Fall semester, you can opt to purchase the Annual insurance instead of the default which is the Fall-Term Policy.

Do I need to pay for the health insurance policy when I sign up?

No. You are simply ordering your insurance through the above step. A charge goes to your Student Business Services account. If you are eligible for the subsidy benefit and elect to participate in the program, then a deferment will be placed on your account for the entire cost of the policy prior to the beginning of the payroll deductions. If you are not eligible for the subsidy benefit, you will need to pay for your policy through Student Business Services prior to the tuition and fee deadline.

Can I change or cancel my health insurance policy?

The student health plan can be canceled or changed up to the date coverage begins. Any plan change/cancelation must be submitted before close of business on the day before coverage begins. Students leaving FSU to enter the military may receive a prorated refund of premium at any time during the academic year. Any request to change or cancel your plan must be made in writing to healthcompliance@fsu.edu. Telephone or walk-in requests are not accepted.

Is there a Spring-only option for buying health insurance?

No. Spring-only coverage is not an option with the university-sponsored health insurance plan.

Where can I find more information regarding the Student Health Insurance Plan?

Please visit the FSU Student Health Insurance website operated by University Health Services for more information regarding purchasing health insurance at the university.

Whom should I contact regarding health insurance?

Please contact University Health Services at 850-644-3608 or at healthcompliance@fsu.edu.

Eligibility

How do I know if I am eligible for the subsidy benefit?

Eligibility Requirements

- Student must sign up for an insurance plan from the FSU Student Health Insurance website.

- Student must be enrolled for at least 9 hours during a given semester.

- Student must have an eligible assistantship from the first day of classes to the last day of exams.

- Student must have a minimum .25 FTE for assistantship.

- Student must have qualifying appointment job code.

If you are eligible, you will receive an election email to your campus email address within the first two weeks of the semester. You must click the link to elect to receive the subsidy benefit by the stated deadline.

What does FTE mean? How do I know my FTE?

FTE stands for "Full-Time Equivalency." An appointment of 10-19 hours per week equals .25-.49 FTE. An appointment of 20+ hours per week equals .5 FTE. You may refer to your offer letter or contact your department HR representative for more information regarding the details of your appointment.

What is an appointment job code? How do I know my appointment job code?

An appointment job code references the type of assistantship you have. You may refer to your offer letter or contact your department HR representative for more information.

What are qualifying appointment job codes?

Eligible appointment job codes include the following: Graduate Research Assistant (M9182), Graduate Teaching Associate (M9183), Graduate Teaching Assistant (M9184), Graduate Assistant (Teaching) (W9185), Graduate Assistant (Professional) (Z9185), and Graduate Assistant (Time Sheet Required (N9185). For a detailed description of each code, please visit the Graduate Assistants Modifiers and Class Codes section of the FSU HR website.

Why am I still receiving the subsidy benefit election email?

The subsidy benefit election email will only be sent out to students who have not made an election by clicking the link in the email. You must make an election indicating whether you would or would not like to receive the subsidy benefit. If you continue to receive the email it means you have not elected in the system. If you feel that you have elected but are still receiving the email, please call the Graduate School at 850-644-3501.

Whom should I contact regarding the health insurance subsidy?

Please contact the Graduate School at gs-subsidy@fsu.edu.

Disbursement

What if my appointment is entered late?

Students who become eligible for the subsidy benefit after the payroll deduction process has begun will be given the subsidy as a payroll supplement at the end of the term. Please see the Post-Term Subsidy Review Request Section below the FAQs.

How is the subsidy disbursed?

The university provides a subsidy towards the amount owed on the health insurance policy over a series of five paychecks as a payroll benefit. The subsidy benefit will be disbursed on a semester-by-semester basis as a pre-tax benefit.

When will I receive the subsidy benefit?

Please refer to the timeline above.

Is the subsidy benefit applied to my paycheck as a lump sum?

The subsidy benefit will not be applied as a lump sum. Instead, the subsidy benefit will be applied as a payroll benefit over a series of five paychecks equally.

How do I know if I am receiving the subsidy?

Your paycheck will indicate the subsidy benefit in the "Employer Paid Benefits" box.

Whom should I contact regarding the health insurance subsidy?

Please contact the Graduate School at gs-subsidy@fsu.edu.

Refunds

If I paid for my insurance before I received the subsidy, will I still have payroll deductions?

Eligible students will be reimbursed for the amount paid toward the health insurance policy, then enrolled into the payroll deduction process. Note: If you receive a refund but owe the university for other expenses, the refund may be applied to pay those other expenses. For specific questions regarding your student account and refunds, please contact Office of Student Finance at 850-644-9452 or studentfinance@fsu.edu.

How will I receive my refund?

Visit the Office of Student Finance for more information on how you will receive your refund.

I am having deductions, but still have not received my refund.

If you have an outstanding balance within the university, your refund may be applied to those balances. For specific questions regarding your student account and refunds, please contact the Office of Student Finance at 850-644-9452 or studentfinance@fsu.edu.

Whom should I contact about my refund?

If you're requesting information about a refund because the full amount of your insurance policy was paid prior to becoming eligible for the Health Insurance Subsidy, visit the Office of Student Finance at 850-644-9452 for assistance.

If you're requesting information about payroll deduction refunds, please visit the Payroll area of the FSU Controller's website or contact them at payroll@fsu.edu or 850-644-3813.

Post-Term Subsidy Review Request

Purpose: This request form is for graduate students who believe they are qualified to receive the Graduate Health Insurance Subsidy benefit and are requesting review of their qualifications for a post-term (after exam week has passed) lump sum payment of the benefit.

Eligibility: Students must meet the eligibility criteria outlined in the above ‘Eligibility’ sub-section ‘How do I know if I am eligible for the subsidy benefit?’.

Students who received an election email and have either declined the benefit (elected 'no') or failed to make an election during the normal enrollment period for the term in question are not eligible for this review. Students who have additional state funded health insurance are also not eligible.

How Does it Work? After exam week has passed, the Graduate School will review the eligibility of students who submitted a request form. If the student is deemed eligible to receive the subsidy, then a lump sum payment will be made to their myFSU account.

If the student has already paid the health insurance charge, the payment will be applied to other outstanding charges on the students’ myFSU account before being refunded.

When are Requests Reviewed? The Graduate School does not process Post-Term Graduate Health Insurance Subsidy requests until after a term has ended (i.e., exam week has passed).

Deadline: Please note that a request for review of eligibility to receive the subsidy benefit for a previous semester is only available for 90 days beyond the start of the subsequent semester. For example, if we are 91 days into the Spring semester, it is too late to request a review based on Fall eligibility.

Form Link: https://fsu.qualtrics.com/jfe/form/SV_eOQOglAKCYQVRVs